Content

And this is ask Claytone anything, a video series where I answer your most pressing questions about SaaS, financials and metrics. https://www.bookstime.com/ Today, we’re shooting from the top floor of the ask Claytone anything tower, and we’re talking about deferred revenue.

Deferred Revenue Definition – Financial Statements – Investopedia

Deferred Revenue Definition – Financial Statements.

Posted: Sat, 25 Mar 2017 18:15:22 GMT [source]

May not like such variable and volatile performance; hence, revenue is reported when earned and not paid. Current LiabilitiesCurrent Liabilities are the payables which are likely to settled within twelve months of reporting. They’re usually salaries payable, expense payable, short term loans etc.

What is deferred revenue?

Most subscription and support services are issued with annual terms resulting in deferred income. Deferred Revenuemeans all amounts received in advance of performance under maintenance contracts and not yet recognized as revenue.

What is the difference between deferred and unearned revenue?

Deferred revenue, also known as unearned revenue, refers to advance payments a company receives for products or services that are to be delivered or performed in the future. Accrued expenses refer to expenses that are recognized on the books before they have actually been paid.

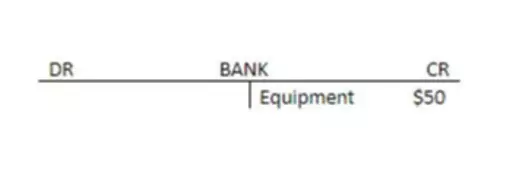

It’s also important to note that in most cases, deferred revenue should be reported as a current liability, as prepayment terms tend to be for less than 12 months. Typical examples of deferred revenues include prepaid insurance policies, annual subscriptions to magazines and newspapers, and others. Once the product or the service is delivered and the order is complete, the firm debits the deferred account and credits sales account. Deferred revenue is typically reported as a current liability on a company’s balance sheet, as prepayment terms are typically for 12 months or less. Deferred revenue is commonplace among subscription-based, recurring revenue businesses such as SaaS companies. When you receive money for a service or product you don’t fulfill at the point of purchase, you cannot count it as real revenue but deferred revenue.

Is unearned revenue accrued revenue?

If companies report only revenues without stating all the expenses that brought them, they will deal with overstated profits. The deferred income, while others may be required to do so after all the products and services are delivered. In such cases, this may lead to varied net profits/losses reported by the Company. The Company may have a period of high profits , followed by periods of low profits. Company XYZ is a software company that sells an antivirus program for PCs and tablets. The company receives advance payments from customers who purchase the software online and expect to download the program on their PCs and tablets once the company receives the payment. Sometimes businesses take an advance payment on a good or service meaning they’ve been paid upfront and now they need to fulfill their end of the deal.

What type of account is deferred revenue?

The deferred revenue account is normally classified as a current liability on the balance sheet. It can be classified as a long-term liability if performance is not expected within the next 12 months.

In a nutshell, it’s an accounting principle, whereby revenues from a contract are recognized over time. For deferred revenue definition example, you sign a 12 month, $12,000 contract with a customer and you invoice the full amount upfront.

Examples of deferred revenue in accounting

Along with an accrued entry also comes the issuance of cash receipts. However, deferred revenue acts as recognition of payments and receipts after payment. ProfitWell Recognized is top-tier accounting software designed to make your revenue recognition process simpler. It helps you automate complicated revenue calculations and situations.